Impact at Scale Requires Capital Discipline, Why Impact Needs the Right Capital at the Right Time (By SDG Impact Partners)

16th January 2026 by CMIA

In sustainable finance and impact investing, we often advocate passionately for change and rightly so. Yet one reflection has become increasingly clear in our holistic work across philanthropy, initiatives and institutional capital: Impact will only scale when innovation respects how capital actually flows in the financial system, not how we wish it would.

Written by SDG Impact Partners and first published here. Shared with permission.

We cannot expect every type of capital to operate outside its fundamental role while expecting it will move fast. Each pool of capital exists for a reason, with distinct mandates, risk tolerances, liquidity needs and fiduciary constraints. When these realities are ignored, even the most promising impact initiatives struggle to scale.

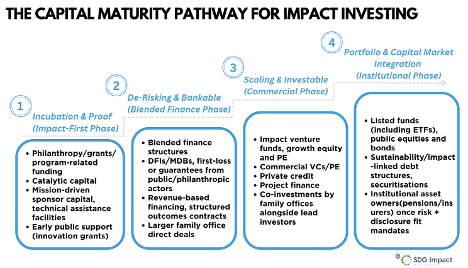

The Four Capital Maturity Stages

Every impactful solution, whether climate, nature, health, or social, typically moves through four distinct stages of capital maturity:

- Incubation & Proof: Philanthropic & Impact-First Capital Supports experimentation, proof of concept, early pilots, and capacity building where risk is highest and financial returns are uncertain.

- De-risking & Bankable: Early Commercial Capital and Blended Finance support validated models with early revenue signals, taking on execution and risk once technical and policy uncertainties are reduced.

- Scaling & Investable: Private Equity & Infrastructure Capital Scales proven solutions with stronger cash-flow visibility, performance track record, and institutional-grade reporting, optimising governance, operating efficiency, and risk management.

- Portfolios & Capital Market Integration: Allocate capital to mature, investment-grade assets through listed equity, debt, and structured vehicles, prioritising liquidity, risk-adjusted returns, and fiduciary duty, and standardised disclosure.

Each stage is essential and none can simply replace another.

A Critical Misalignment We Often See

We shall accept that capital markets function precisely because different capital plays different roles at different stages. Asking one type of investor to step too far outside its natural mandate is not ambitious, it is often how good ideas fail. Too often, we ask:

- Philanthropy is treated as a parallel moral activity, rather than as a strategic and catalytic part of the capital continuum

- Venture capital is expected to absorb public-policy or system-level risk that is not yet investable

- Public markets are looked to for funding unproven innovation and processing them fast

- Institutional capital is often asked to assume earlier-stage risk without investment-grade evidence, appropriate structuring, or risk-adjusted returns aligned to fiduciary duty

“ Innovations with real impact potential fall between capital stages: too early for commercial capital, too large for grants, and too risky for markets. These disconnects create friction, slow scale and leave high-potential impact initiatives stranded between capital maturity stages. Impact investing does not fail for lack of goodwill or even a lack of capital, but mostly because capital sequencing is inefficient. ” – Tina Min, Founding Partner, SDG ImpactPartners

A Key Reflection

Impact efforts falter when we misunderstand capital maturity, risk tolerance, and fiduciary realities. If we design impact investing systems with the 3Rs:

- Respect capital roles at each stage as the foundation for financial product innovation

- Reduce friction between stages

- Relate impact-first outcomes into investment-grade evidence

Then scale becomes not only possible, but inevitable.

If we want impact to scale, we need to stop designing as though capital is one homogenous pool.

Capital has jobs, and those jobs matter.